Introducing

Piggy Bank

Users can build confidence in their financial knowledge, start investing with minimal funds, and feel empowered to make smart financial decisions without feeling overwhelmed.

Project overview

The Kick-Off

Project type: UX/UI Design Hackathon

Timeline: 8-Hours (One day)

Role: UX Researcher, Design Strategist

Tools: Figma

Empathize

Problem statement

Young and middle-aged adults face barriers to investing due to student debt, rising living costs, and limited financial resources, hindering their path to long-term financial security.

Secondary research

Despite over half of Gen Z already participating in the stock market, many struggle with understanding investing and risk management. A significant 32% cite fear of losing money as a barrier to investing, while 22% of those not currently invested express a lack of trust in the market.

Lack of income, small down payment size, and no credit history are usually the primary challenges you will face when buying a home as a student.

The rise of #FinTok has significantly influenced Gen Z investing habits, with 48% of Gen Z investors turning to social media for financial advice. According to a CFA report, these platforms are now the primary source of information for young investors in the US, Canada, and the UK.

- Many schools do not include comprehensive financial literacy in their curricula. As a result, young adults graduate without a clear understanding of basic financial concepts like saving, budgeting, and investing.

%

Of Gen Z are investing at stock market

Versus

%

Of 52-62 years olds

Primary research

Due to the project’s one-day timeline, we weren’t able to conduct formal interviews. However, since all hackathon participants were young adults, they shared insights from their own investment experiences, providing valuable perspectives. Here are the key insights gathered from their discussions.

Investing can be intimidating

Without foundational knowledge, young adults may view investing as risky or difficult to navigate, deterring them from exploring it on their own

Vancouver living expences

High living costs in Vancouver create significant obstacles to investing

Big student loan

” I have a big student loan to pay I cant think of investing” – said a Gen Z individual.

Middle age crises

Fear of insufficient retirement saving makes individuals in their mid ages so nervous.

Define

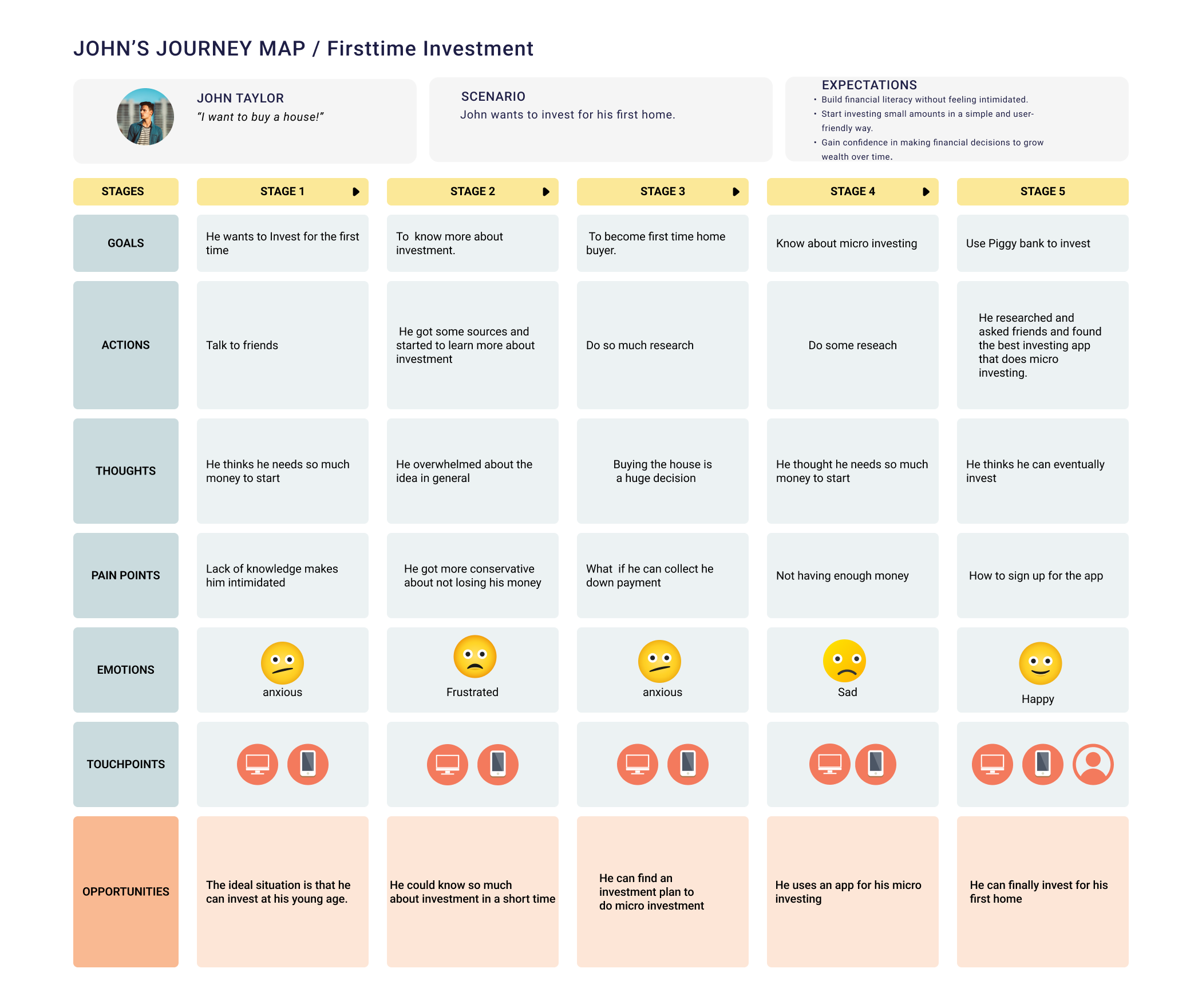

Persona and Experience map

Choosing a persona from Gen Z as the target user for the app brings a few key insights and considerations to the design process.Gen Z, typically defined as those born from the late 1990s to early 2010s, has distinct characteristics and expectations shaped by their unique experiences growing up in a digitally advanced and often financially challenging world.

Jamie Taylor

Age: 24

Occupation: Junior Marketing Specialist

Location: Urban area, renting a small apartment

Education: Bachelor’s degree in Communications

Income: $35,000 annually

Jamie is a young professional, living on a tight budget while starting their career in marketing. They are eager to build a stable financial future but feel overwhelmed by the complex world of investing. Jamie has a few friends who talk about stocks and crypto, but they often feel left out due to a lack of knowledge. After paying rent, bills, and essentials, there’s usually only a small amount left each month, which they want to save or invest to grow over time

Demographics:

- Tech-savvy, often on social media, and has a smartphone.

- Prefers to use apps for banking, budgeting, and financial planning.

Goals

- Build financial literacy without feeling intimidated.

- Start investing small amounts in a simple and user-friendly way.

- Gain confidence in making financial decisions to grow wealth over time.

Pain points

- Limited funds make it feel like investing isn’t feasible.

- Intimidated by jargon-heavy investment platforms.

- Fears losing money due to a lack of knowledge and experience.

- Finds traditional investment platforms complex and uninviting.

Motivations

- Desire for financial independence and security.

- Wants to learn about finances and grow their money without feeling overwhelmed.

- Inspired by peers who are investing, but unsure how to start.

Personality traits

- Curious but cautious.

- Financially anxious, with a practical approach to money.

- Tech-literate and eager to learn, especially through mobile apps.

Design Challenge

How might we help young investors gain the knowledge and confidence to invest?

Ideate

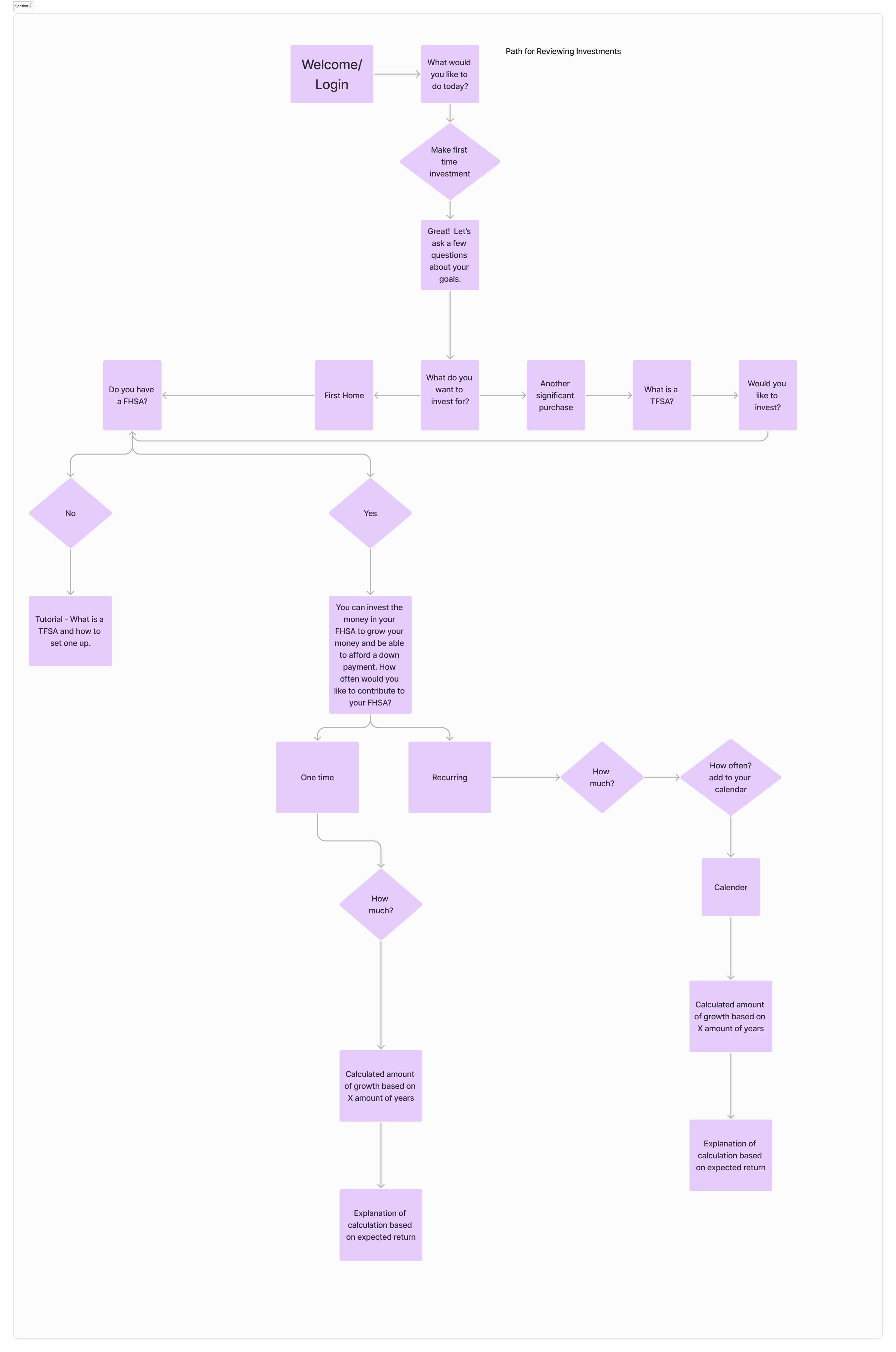

Brainstorm and userflow

Creating an Investment application for GenZ

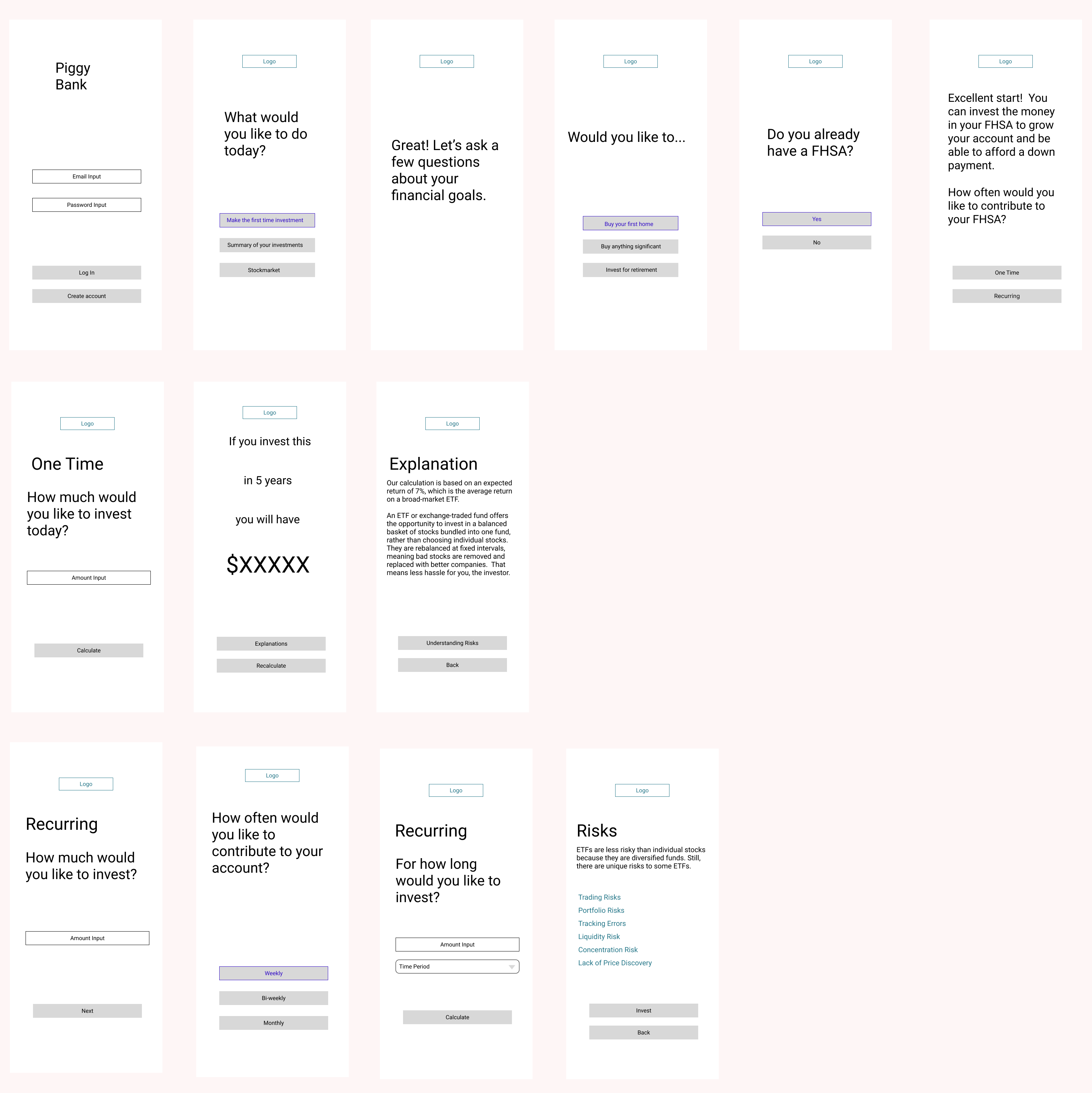

After two hours of brainstorming with the team, we refined our approach to address young adults’ investment concerns by focusing on creating a user experience that demystifies the investment process. We outlined ways to make the app feel approachable, with features that support small, low-risk investments, simplified financial terms, and educational tools to build confidence gradually.The following user flow was created to guide users through the investment process in the app in a clear, straightforward way, directly addressing their concerns and gradually building their confidence as they proceed through each step.

Introducing:

Piggy Bank

To help beginners start investing small amounts with confidence by providing easy-to-understand information, low-risk investment options, and a supportive, engaging experience.

App's Features

Investment calculator for FHSA helps him estimate how much his account balance could grow over time, based on his annual contributions, investment returns, and timeframe.

Retirement Investment which common options include:

- RRSP (Canada) / 401(k) / IRA (U.S.)

- Tax-Free Savings Accounts (TFSAs) in Canada

- Employer-Sponsored Plans

Stock Market including

- Index Funds and ETFs (Exchange-Traded Funds) that track the performance of major indices (like the S&P 500)

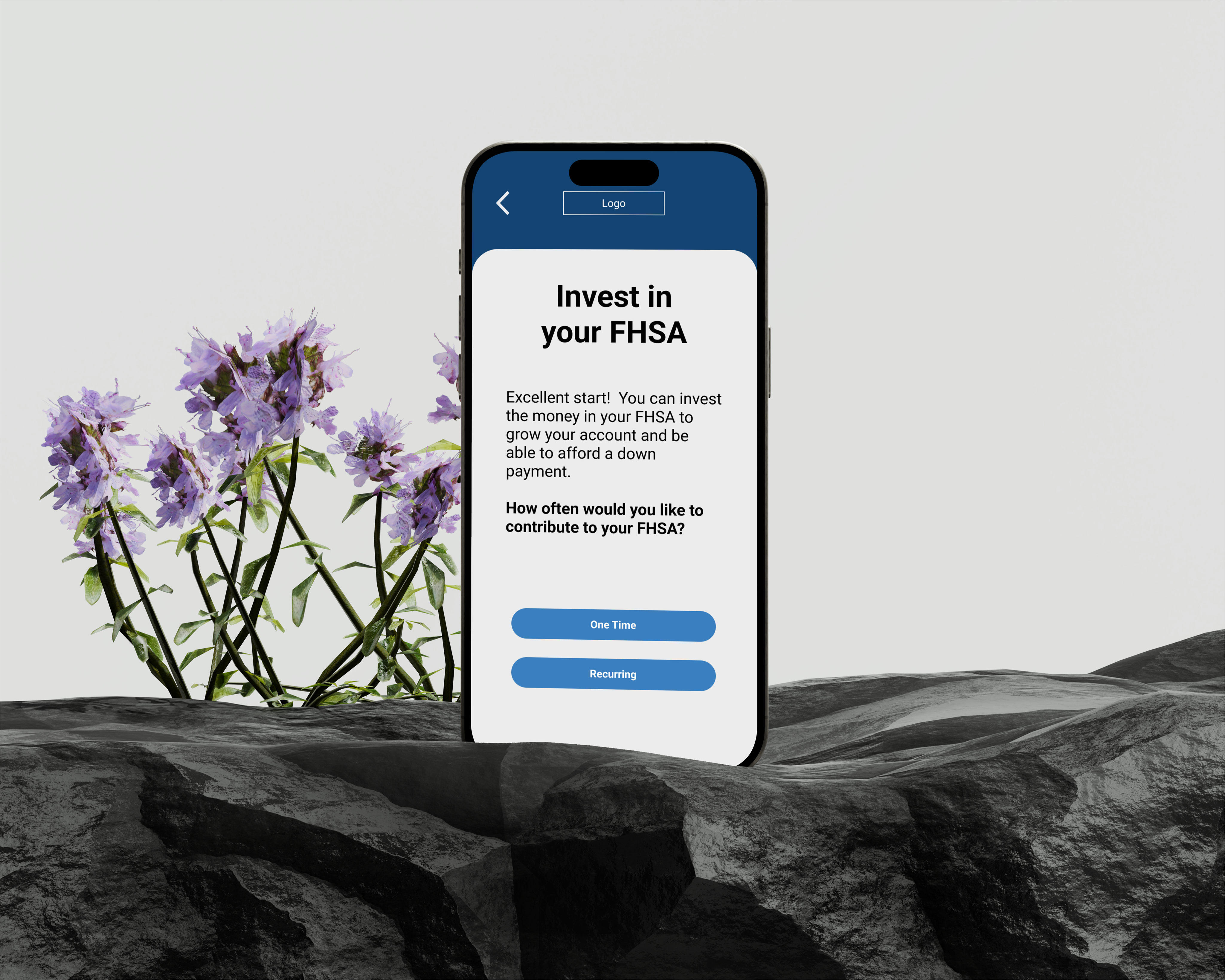

Prototype

In the final hour of our hackathon journey, we needed to quickly think through the Wireframes. While the app has extensive potential, we chose to focus on just one key flow to ensure we delivered a clear, functional concept within our time constraints.

In our final minutes, we managed to create a Prototype for our application, which showcases the main user flow and highlights how the app simplifies the investment process for young adults. This prototype captures the core features that address user concerns, offering an intuitive and approachable experience tailored to their needs.

https://www.figma.com/design/CuN1njOF3k8Ir13aOuT3xT/Prototype?node-id=0-1&t=adCUmBN45Nf9Qo2z-1

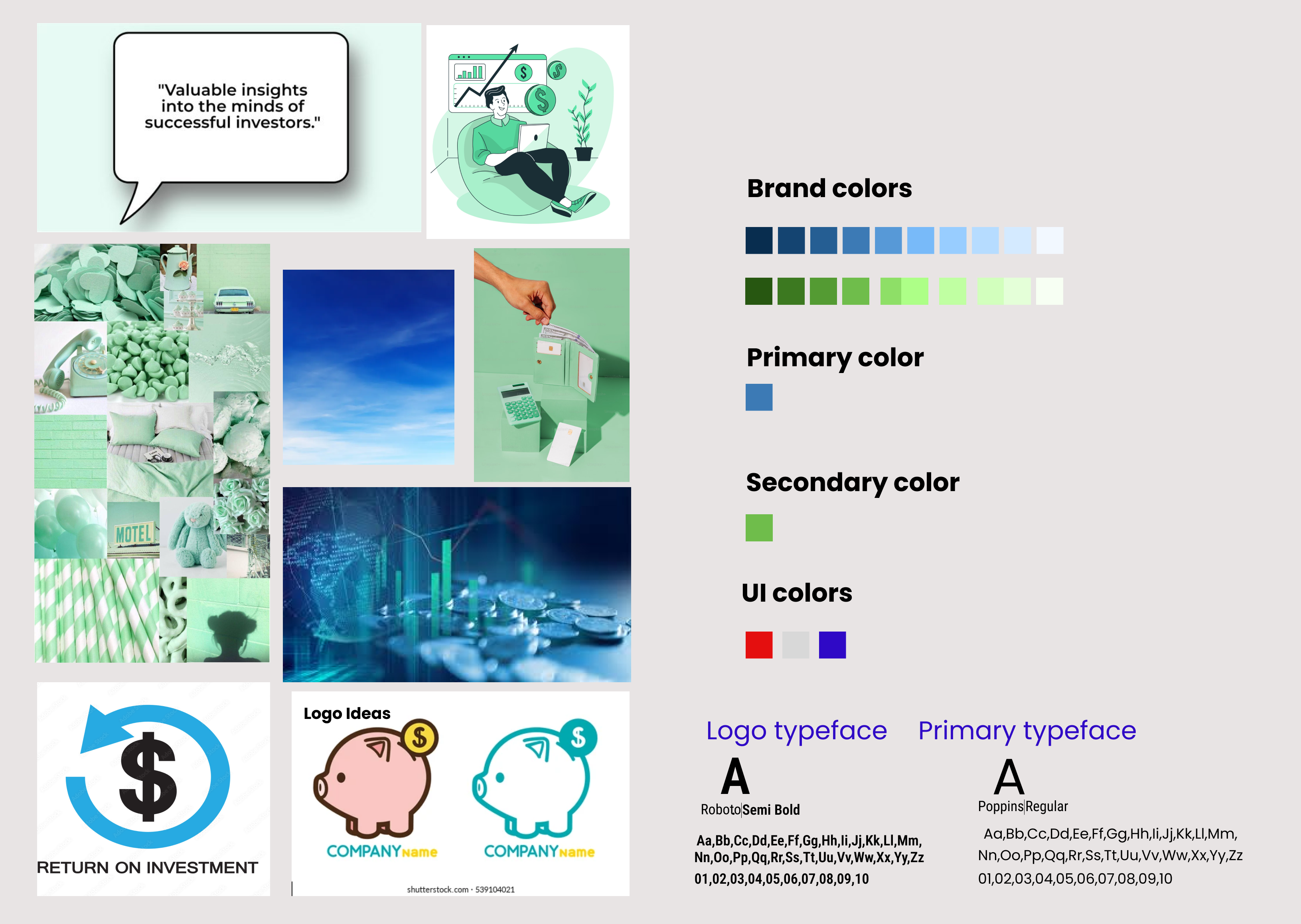

Visual Suggestions

Since there was no time to work on branding, the following elements are recommended for further development.

Future Steps

Piggy Banks Market

Market Suggestions

Understand the target audience

Promote Key Features That Address Pain Points

Leverage Social Media and Influencer Marketing

Incorporate Gamification and Social Elements

Offer Introductory Promotions or Trials

Educate Through Content Marketing and Resources

Take home lesson

The best designs come from team collaboration.

Joining a UX/UI design program just two months before the hackathon provided an exciting opportunity for rapid learning and growth. The event offered a chance to collaborate with individuals from diverse backgrounds, enriching the design process with varied perspectives. Sharing ideas in this high-energy environment boosted my confidence, refined my communication skills, and highlighted the importance of teamwork, adaptability, and resilience in UX/UI design. Overall, it was an intensive yet rewarding experience that accelerated my understanding of the creative and collaborative aspects of design.

More Projects

Brandmegaphone is a digital marketing agency that specializes in creating impactful advertising campaigns for businesses.

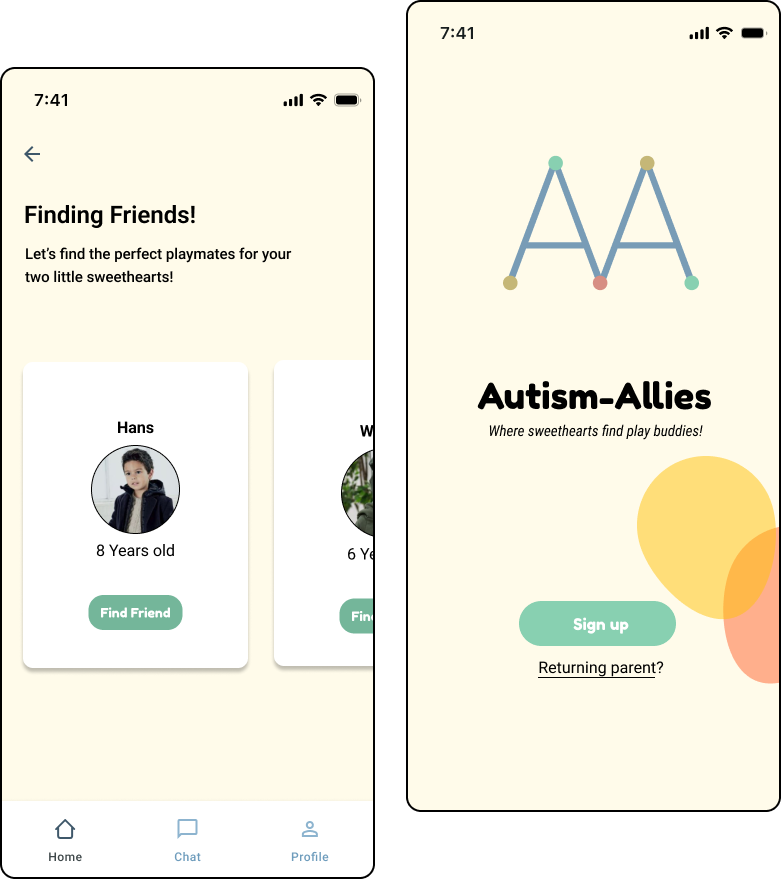

Autism Allies connects autistic kids to enhance social activities and provide greater benefits for them.

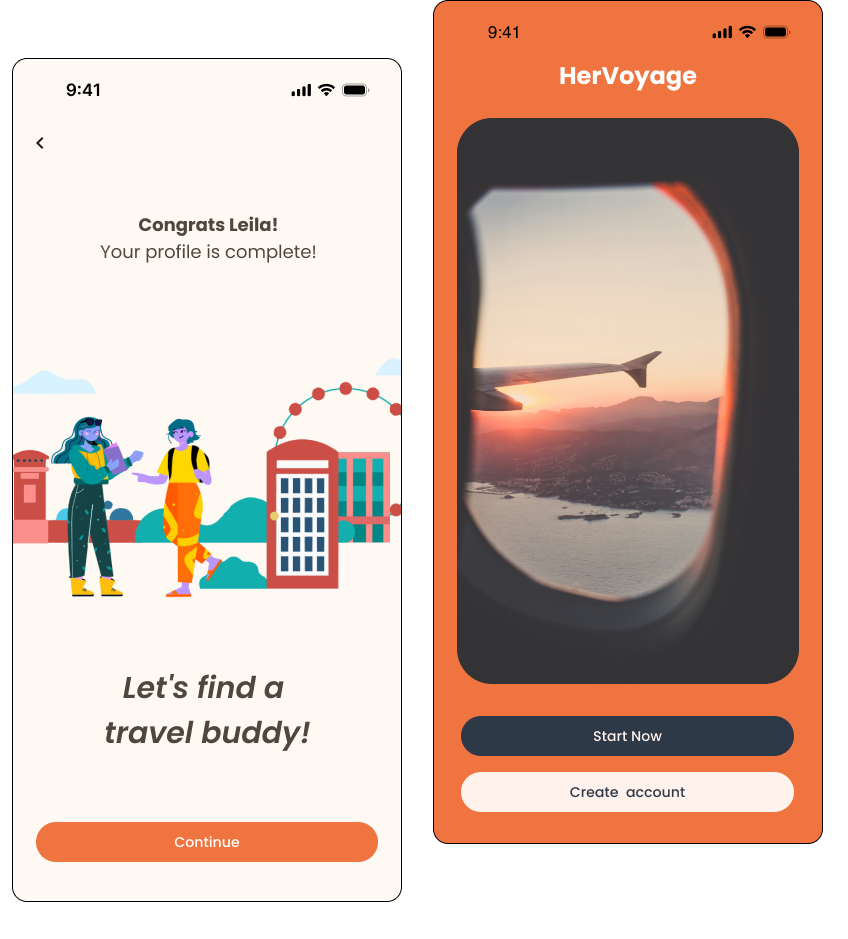

Her Voyage helps the solo women traveller find companions for their trip.

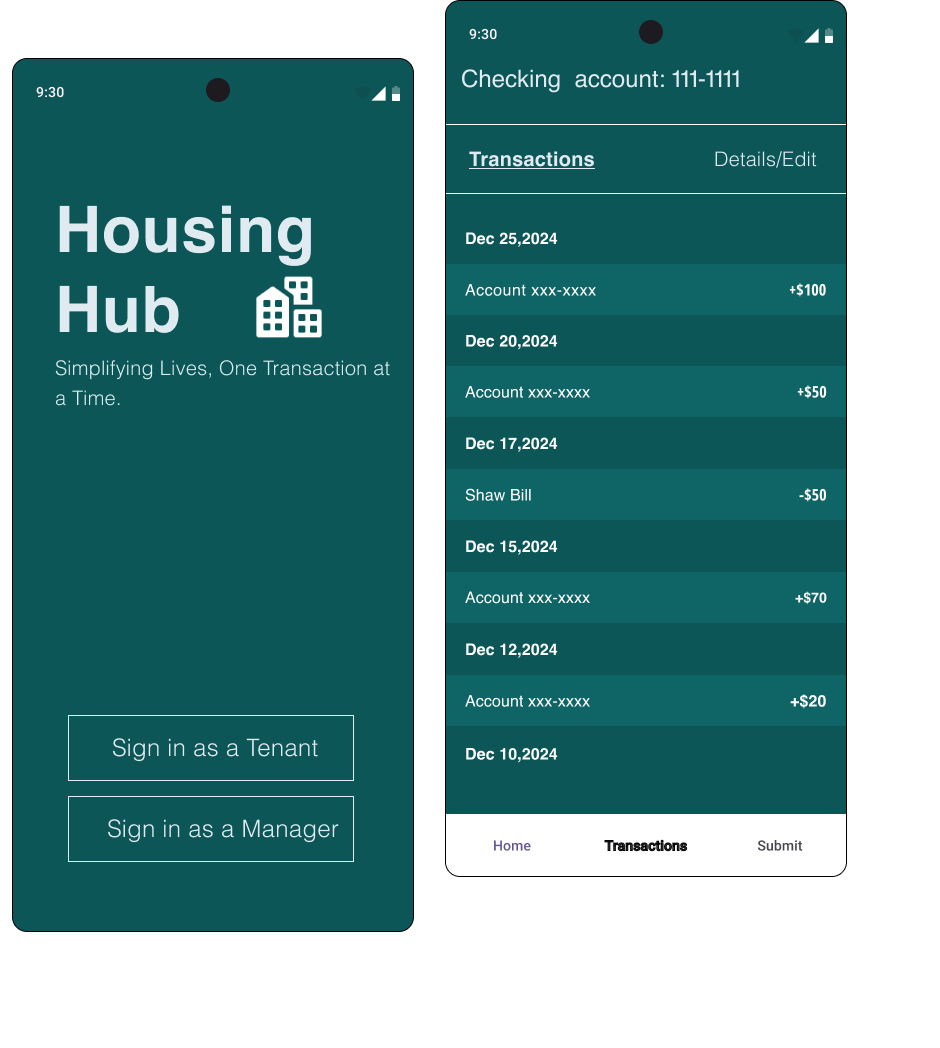

The BC Housing Streamline Project aims to improve the housing application and management process for both tenants and BC Housing staff